In real estate investment and urban development, there are situations where numerical analysis is needed to see whether investments or public works can achieve the necessary goals.HibiiX provides data analysis services that respond to various development projects and real estate investment situations.

Benefit and cost analysis in regards to redevelopment of urban areas (B/C)

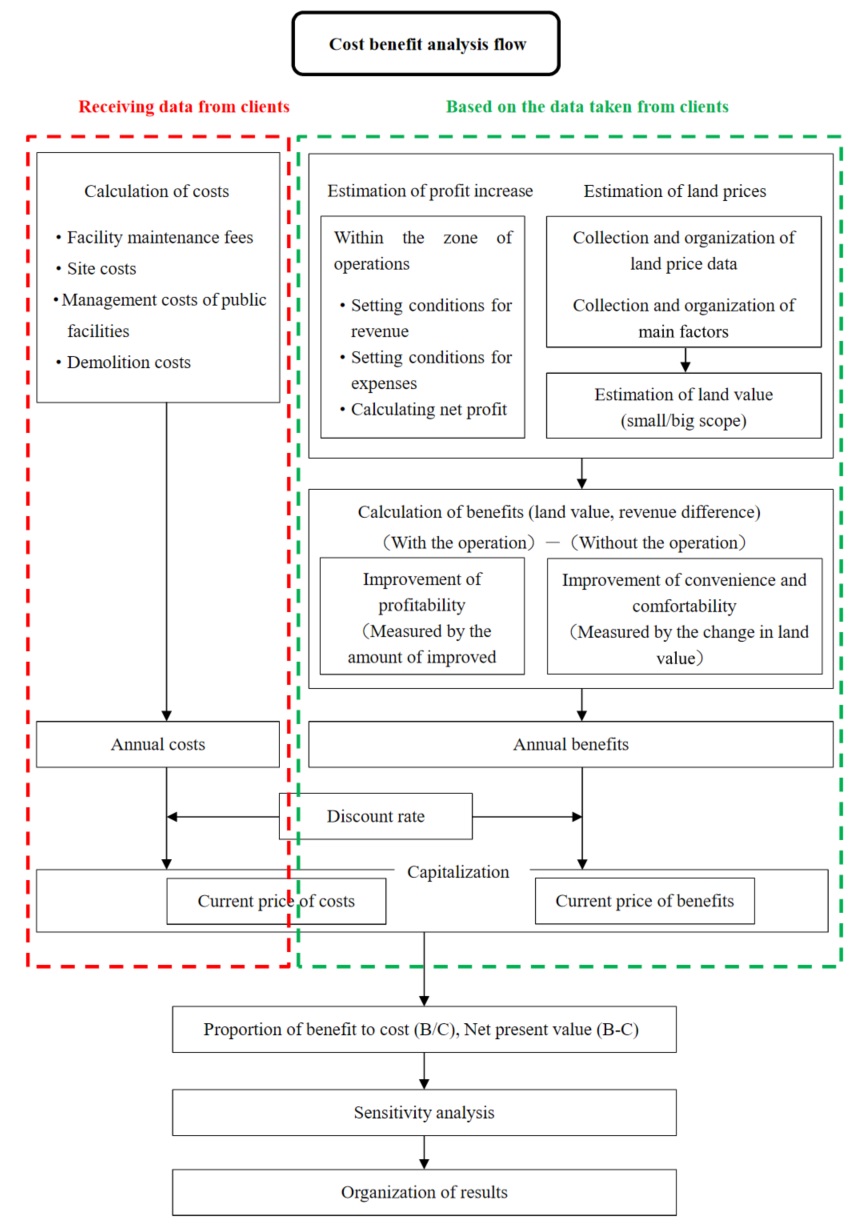

A “business effect” is sought from society when the redevelopment of an urban area is publicly funded. Therefore, a benefit and cost analysis is required to evaluate the operation, particularly when considering funding (including the period after an operation has been funded).

A cost and benefit analysis is defined as:

A necessary analysis method to asses a new operation under consideration for an area that is to be redeveloped. Based on The Ministry of Land, Infrastructure and Transport’s “benefit and analysis manual on operations of urban redevelopment,” an analysis is carried out with a hedonic approach.As an index for evaluation, the formula below is measured on a monetary scale.Proportion of benefit to cost (B / C) = Benefit to society (Benefit) ÷ Cost to society (Cost)

Net asset value (B -C) = Benefit to society (Benefit) - Cost to society (Cost)

A tax revenue effect evaluation relating to urban redevelopment operations

It is required with a benefit and cost analysis (B/C) when a new urban redevelopment operation is being considered.

Tax revenue effect evaluation is defined as:

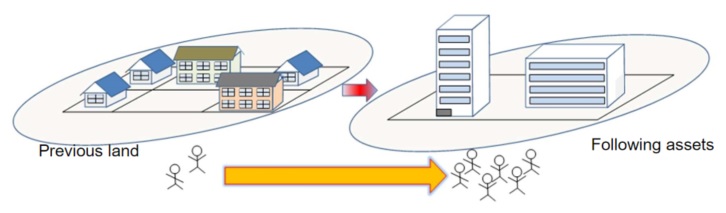

Buildings and surrounding areas to be serviced by an urban redevelopment operation are subject to tax revenue changes of a resident/business moving in, increases of land value and local government service costs. A tax revenue effect evaluation calculates the change in tax revenue and fees. Then it measures and evaluates the economic impact it has on the local government. The amount of tax and change is calculated within a 500-meter radius from the center of the operation.

Changes in tax revenue

The following are given as entries for a change in tax revenue.

(1) Tax affected by a change in property value・・・・・fixed property tax, city planning tax

(2) Tax affected by a transfer of property・・・・・・・・sales tax (local)

(3) Tax affected by a resident/business moving・・local resident tax, tobacco tax, business office tax

Variable charges

The city’s share of the expenses below can fluctuate.

(1) The city’s share of a subsidiary aid

(2) Administration service costs

1. Tax influenced by a transition in asset value

2. Changes to administration services costs

3. The city’s share of a subsidiary aid

4. Tax influenced by a resident moving

5. Tax influenced by a business moving

Other economic impact analysis within city operations

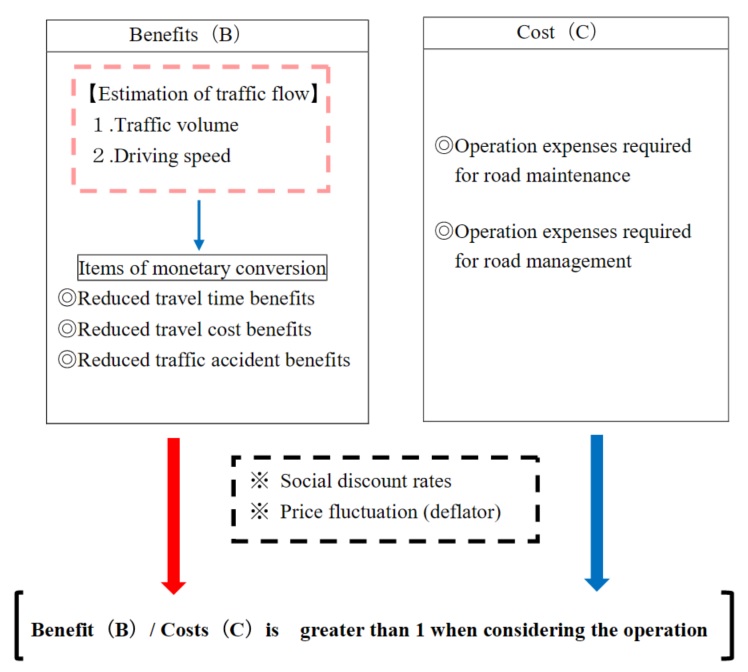

◎Evaluations of road operations

When considering new operations for roads, construction must start before five years and be evaluated after the operation is finished. Roads, tunnels and the installation of pedestrian bridges can be considered as road operations. Benefit and cost analysis (B/C) is carried out towards operations, and an evaluation index is presented with measurements on a monetary scale.

◎Benefit and cost analysis related to land readjustment operations (B/C)

Similar to an urban redevelopment program, the community demands a “business effect” when it comes to a publicly funded land readjustment operation. Therefore, a benefit and cost analysis is required mainly to evaluate the operation when considering subsidiary aids.

Proportion of benefit to cost (B/C) = benefits to society / costs to society

※1. Benefit to society

Based on whether there is an operation or not, the total land rent is calculated using various land rent figures. With this as the current value, the benefit is calculated.

※Cost to society

Costs are the operation expenses, maintenance fees and the land costs of increased public sites. Furthermore, the maintenance fees of sewage companies are added to operating expenses. With this as the current value, costs are calculated.

Calculation of investments and analysis of income towards real estate development operations

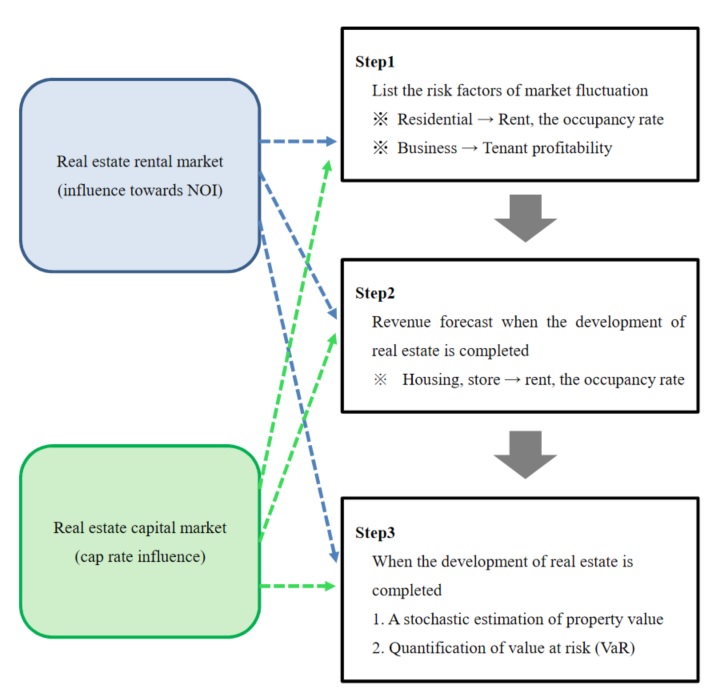

【Method 1】 Analysis of investment and market risk

We quantitatively evaluate the influences of future uncertainty for the real estate market as a fluctuation risk of real estate value. The uncertainty of fluctuation in cash flow or future value of assets is evaluated and analyzed by using random variables, probability distribution (volatility σ), risk-sensitive index (β) and value at risk (VaR), etc.

【Method 2】Credit rating of real estate investment.

We evaluate real estate investment from a financial perspective by extracting the judgment index from the cash flow list which utilizes the discounted cash flow method, hereinafter”DCF method.”

The DCF method discounts the net income in each period during the holding period and the selling price at the time of the holding period expires from the present value according to the risk and determines the balance of a period.The DCF method in real estate appraisal is used to total the present value in each period and determine asset value.

・IRR(Internal Rate of Return)

The internal rate of return, hereinafter “IRR,” is the investment’s rate of return that evaluates the ratio of future cash flows by its present value and is used to determine whether the investment can be made or not. If the IRR is greater than the investor’s expected discount rate, the investment is considered valid.

・DSCR(Debt Service Coverage Ratio)

The debt service coverage ratio, hereinafter “DSCR,” is the ratio of the net income before debt repayment and shows the safety level of debt repayment from the perspective of net income. DSCR is mainly used as an index when financial institutions make loans.

DSCR = cash flow before payment of principal and its interest for each year / payment of principal and its interest each year

・LTV(Loan to Value)

The loan to value, hereinafter “LTV,” is an index that shows the certainty of repaying the principal and used as a standard for credit enhancement for debt.

LTV = Amount of liability / asset price (profit price)

Trade Area Brief Analysis AREAINFO

Click here for Trade Area Brief Analysis AREAINFO.