By hoping for a better future and changing ideas, we solve problems and support businesses.

HibiiX provides services having to do with the following urban development operations.

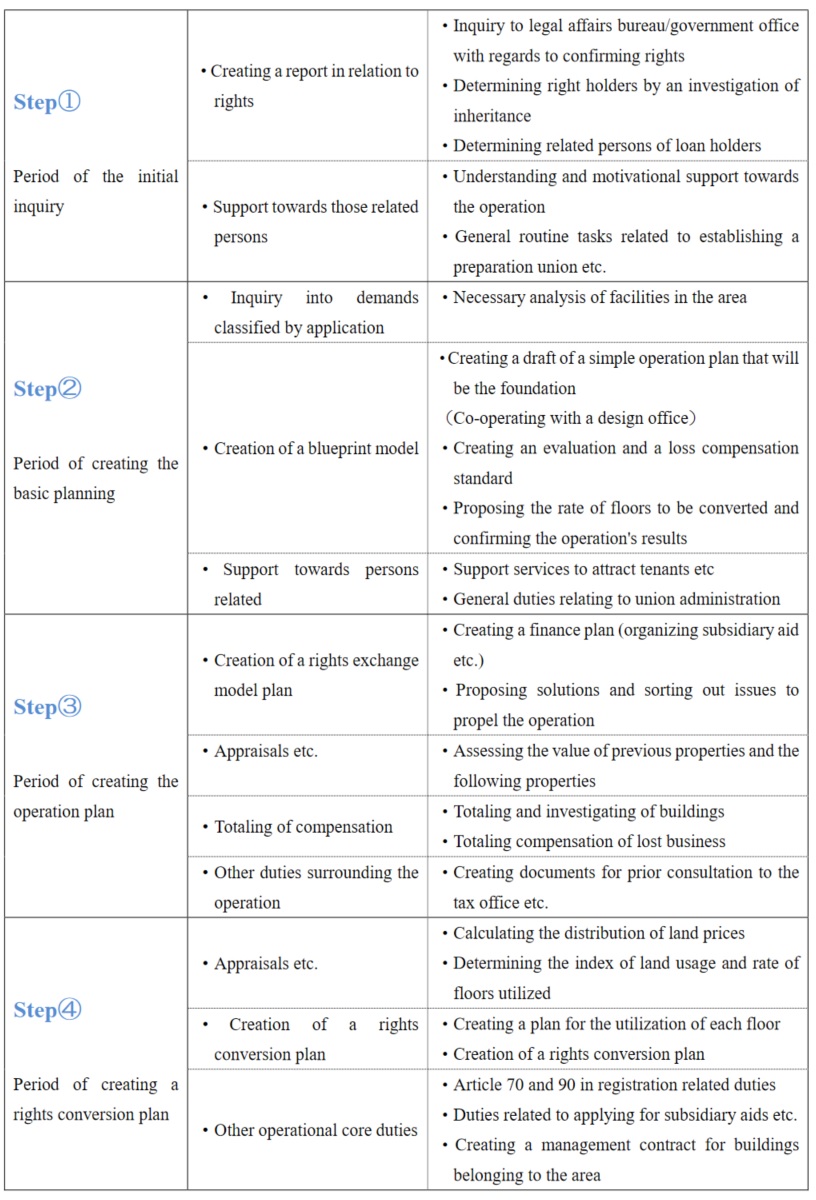

Business support details in regards to the city redevelopment etc.

Benefit and cost analysis in regards to redevelopment of urban areas (B/C)

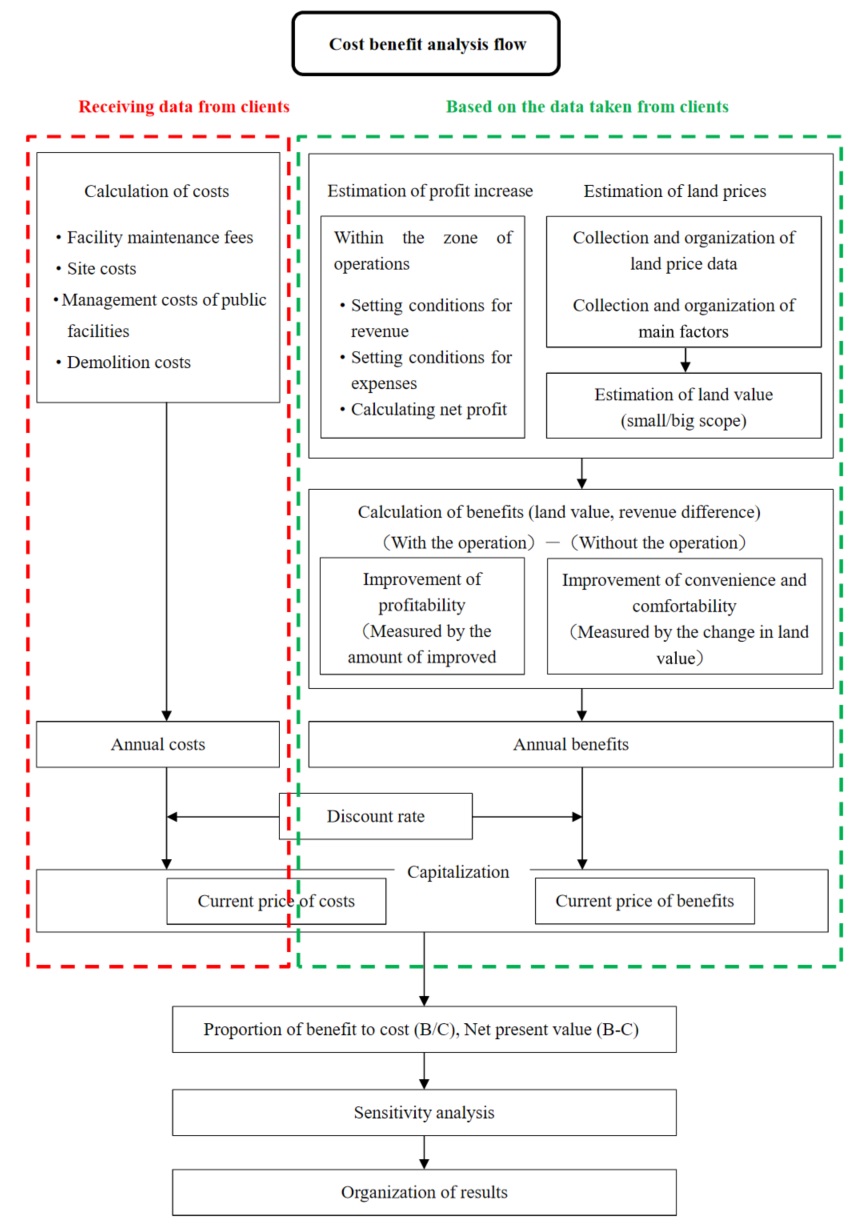

A “business effect” is sought from society when the redevelopment of an urban area is publicly funded. Therefore, a benefit and cost analysis is required to evaluate the operation, particularly when considering funding (including the period after an operation has been funded).

A cost and benefit analysis is defined as:

A necessary analysis method to asses a new operation under consideration for an area that is to be redeveloped. Based on The Ministry of Land, Infrastructure and Transport’s “benefit and analysis manual on operations of urban redevelopment,” an analysis is carried out with a hedonic approach.As an index for evaluation, the formula below is measured on a monetary scale.Proportion of benefit to cost (B / C) = Benefit to society (Benefit) ÷ Cost to society (Cost)

Net asset value (B -C) = Benefit to society (Benefit) - Cost to society (Cost)

A tax revenue effect evaluation relating to urban redevelopment operations

It is required with a benefit and cost analysis (B/C) when a new urban redevelopment operation is being considered.

Tax revenue effect evaluation is defined as:

Buildings and surrounding areas to be serviced by an urban redevelopment operation are subject to tax revenue changes of a resident/business moving in, increases of land value and local government service costs. A tax revenue effect evaluation calculates the change in tax revenue and fees. Then it measures and evaluates the economic impact it has on the local government. The amount of tax and change is calculated within a 500-meter radius from the center of the operation.

Changes in tax revenue

The following are given as entries for a change in tax revenue.

(1) Tax affected by a change in property value・・・・・fixed property tax, city planning tax

(2) Tax affected by a transfer of property・・・・・・・・sales tax(local)

(3) Tax affected by a resident/business moving・・local resident tax, tobacco tax, business office tax

Variable charges

The city’s share of the expenses below can fluctuate.

(1) The city’s share of a subsidiary aid

(2) Administration service costs

1. Tax influenced by a transition in asset value

2. Changes to administration services costs

3. The city’s share of a subsidiary aid

4. Tax influenced by a resident moving

5. Tax influenced by a business moving

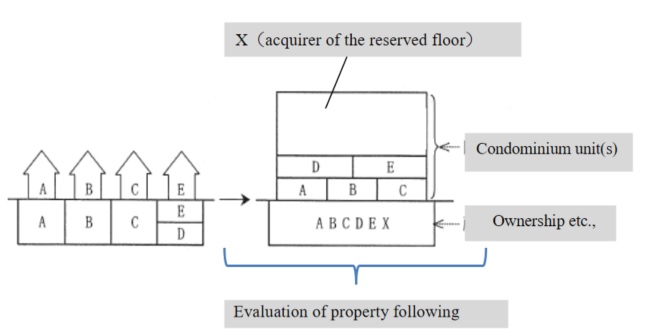

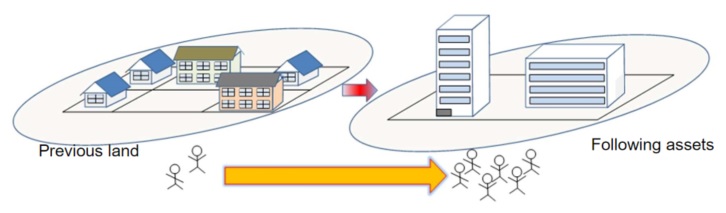

Evaluation of previous land/building and following assets in relation to an urban redevelopment operation

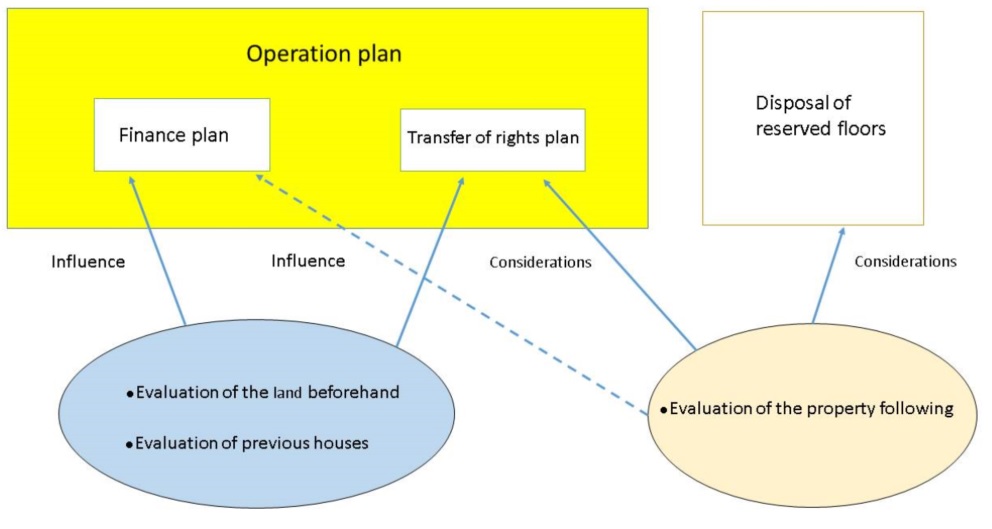

In order for HibiiX’s real estate appraisers, redevelopment planners and compensation consultants to lead to a plan of exchanging land/building rights, a survey is carried out on the current situation of real estate within the region of operation and evaluation is carried out on the previous land/building and following assets.

Evaluation of the previous property

Based on a site investigation, the real estate appraiser and compensation consultant create an evaluation and compile compensation data that lead to a rights transfer plan(1) For land:

Step① Determining evaluation policies ↓ Step② Determining neighboring regions, appraisal of a standard plot ↓ Step③ Land evaluation standard, creation of a comparison table ↓ Step④ Creation of a table that calculates and evaluates parcels of land (2) For houses:

Mainly compensation consultants investigate the interior of houses to check the construction and condition. They calculate the building’s current value and compensation costs for reconstruction. In regards to totalization, a standard for total compensation is created with reference to The Association of Liaison & Consultation for Land and it will be calculated based on that standard.

Post evaluation

The expansion of roads, development of towns and utilization of facility buildings etc., are taken into consideration and evaluated.

Other economic impact analysis within city operations

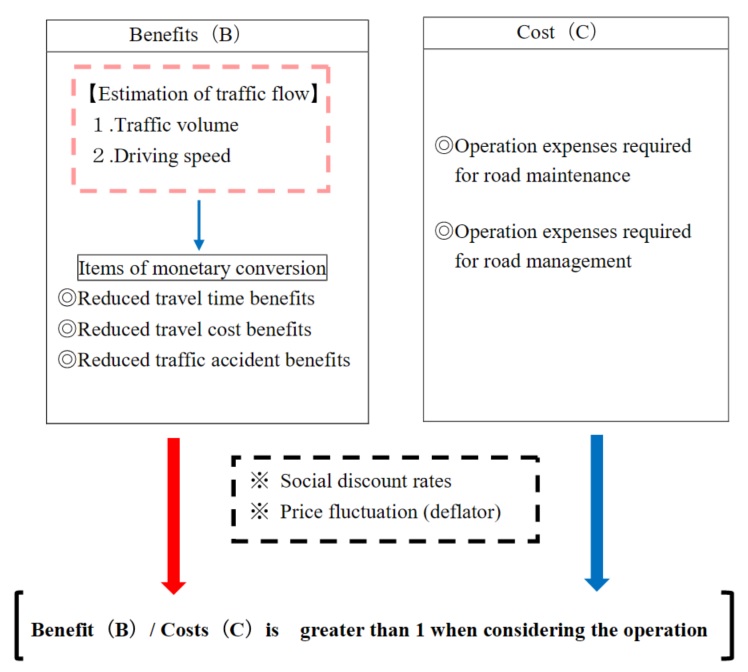

◎Evaluations of road operations

When considering new operations for roads, construction must start before five years and be evaluated after the operation is finished. Roads, tunnels and the installation of pedestrian bridges can be considered as road operations. Benefit and cost analysis (B/C) is carried out towards operations, and an evaluation index is presented with measurements on a monetary scale.

◎Benefit and cost analysis related to land readjustment operations (B/C)

Similar to an urban redevelopment program, the community demands a “business effect” when it comes to a publicly funded land readjustment operation. Therefore, a benefit and cost analysis is required mainly to evaluate the operation when considering subsidiary aids.

Proportion of benefit to cost (B/C) = benefits to society / costs to society

※1 Benefit to society

Based on whether there is an operation or not, the total land rent is calculated using various land rent figures. With this as the current value, the benefit is calculated.

※2 Cost to society

Costs are the operation expenses, maintenance fees and the land costs of increased public sites. Furthermore, the maintenance fees of sewage companies are added to operating expenses. With this as the current value, costs are calculated.